Fibonacci With Stochastic Indicator

Article Summary: When studying how to place trades in the direction of the trend many traders focus on the used by technical traders. However, by adding Fibonacci to your trading, not only can you locate future targets for stops and exits but you can also find triggers to improve your forex trading results in as little as two steps.Every trader wants to find high probability set-ups. Naturally, we feel that trading in the direction of the overall trend is the best way to put the odds of success in your favor. Beyond trading in the direction of the dominant trend there are a few tools that you can use to help you find specific entry and exit targets. What Are Fibonacci Numbers?In short, Fibonacci numbers or ratios are mathematically significant numbers that occur throughout nature and often in financial markets. They were discovered by Leonardo de Pisa in the 13 th century and he was known as the most talented Mathematician in the middle ages. The most important number or ratio is the 61.8% or.618 levels.

There is also a 1.618 Extension along with 2.618. In Forex trading, Fibonacci retracements can identify Learn Forex: Important Fibonacci Levels Applied to EURUSD to Find Support. From a trading perspective, the most commonly used Fibonacci levels are the 38.2%, 50%, 61.8% and sometimes 23.6% and 76.4%. In a strong trend, which we always want to be trading, a minimum retracement is around 38.2%; while in a weaker trend, the retracements can be 61.8% or even 76.4%. A complete retracement or break of 100% of the prior move would nullify the current move. How Should I draw The Fibonacci Retracement Trend Line?The most important thing to know is that the base of the trendline should be drawn from left to right.

If there is a and you’re currently noticing a retracement to the downside then you’d want to look for support at one of the levels appearing on the chart like we see above on EURUSD. If there is currently a bearish (down) trend and a retracement is taking shape then you’d want to look for resistance. Learn Forex: Important Fibonacci Levels Applied to GBPUSD (Looking For Resistance)An important note about using any trading metho dology is that neither you nor I can guess with perfect accuracy a future move. So the next best thing is to watch closely levels of.

The Fibonacci Retracement tool can play a key role in many breakout trading strategies. Any trading signal generated by other technical analysis tools can be confirmed with the Fibonacci Ratios and their PRZ. In addition, a stop-loss order can be more reliable and more accurate if it is placed above or below major Fibonacci support or resistance zones. .How to filter for high probability trading setups with the Stochastic indicator.How to use the Stochastic indicator to better time your entry Are you ready to rock with the Stochastic indicator?

Once you notice a strong move off of support in an uptrend or resistance in a downtrend then you can use further levels of resistance as price targets. Two Methods Of Trading Fibonacci To Find Likely Price TargetsThe two methods we’ll address in this article to trade Fibonacci are using the Fibonacci Retracement levels in the direction of the prevailing trend and using either Fibonacci Retracement / Extensions as targets or Fibonacci Expansion Tool.As a refresher, the prevailing trend is the one you’re using to draw the Fibonacci line from.

Therefore, in a prevalent downtrend, because you drew from left to right and top to bottom, you are looking for resistance being honored and move back to the downside. LEARN FOREX: AUDUSD Shows How You Can Use Retracements As Price Targets Fibonacci Projection RulesFirst and foremost, you want to focus on trading in the direction of the trend of the chart you are trading on. The weekly trend may vary from the trend on the 4 hour chart, but if you’re trading on the 4 hour chart than that is the trend you should be focusing on. Fibonacci Price ExtensionsAn easy way to think of Fibonacci extensions vs. Retracements is that extensions go beyond 100% with the same tool used to find retracement levels.

To find an extension level on a new downtrend you would run the low to high extension for possible support. Reversely, on a new uptrend, you would run the high to low extensions for possible resistance that can act as profit targets.

The levels most commonly used are the 1.00%, 1.272%, 1.618%, 2.00% or 2.618%. LEARN FOREX: Fibonacci Extensions Look Beyond the 100% Level For Price Targets – AUDUSDChart Created by Tyler Yell, CMT Fibonacci Expansions or Price Objectives Is Your Third Tool Optionare different than Extensions even though they sound similar. The main variation is that you’re now using three key pivots in the market to find your target level. For potential resistance or buy targets, you would draw from a major low to a major high back to a major low to get resistance.

For potential support or selling targets you would draw from a major high to major low back to another major high from left to right.In summary, if you’re using two points alone, you’re using retracements or extensions. If you’re using three points for your target, then you’re using expansion or price objectives. The common levels used for expansions are 0.618, 1.00, and 1.618. LEARN FOREX: Fibonacci Expansions Looks To Each Level As Next Possible Target – AUDUSD & GBPUSD Closing ThoughtsFibonacci Expansions and Extensions can be great leading indicator of price targets once a Retracement level is honored. Deciding which tool to use is a personal choice for price targets as both methods have their benefits.

Because this tool is taking you into new price territory, trailing stops are recommended along with the proper trade size so that your risk is always contained.Happy Trading!Next: (26 of 50)Previous:Discover the, and how you can replicate and implement them into your trading strategy. About your FOREX.com Demo AccountA demo account is intended to familiarize you with the tools and features of our trading platforms and to facilitate the testing of trading strategies in a risk-free environment. Results achieved on the demo account are hypothetical and no representation is made that any account will or is likely to achieve actual profits or losses similar to those achieved in the demo account. Conditions in the demo account cannot always reasonably reflect all of the market conditions that may affect pricing and execution in a live trading environment. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances.

Forex trading involves risk. Losses can exceed deposits. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading.FX Publications Inc (dba DailyFX) is registered with the Commodities Futures Trading Commission as a Guaranteed Introducing Broker and is a member of the National Futures Association (ID# 0517400). Registered Address: 32 Old Slip, Suite 803; New York, NY 10005.

Best Stochastic Indicator

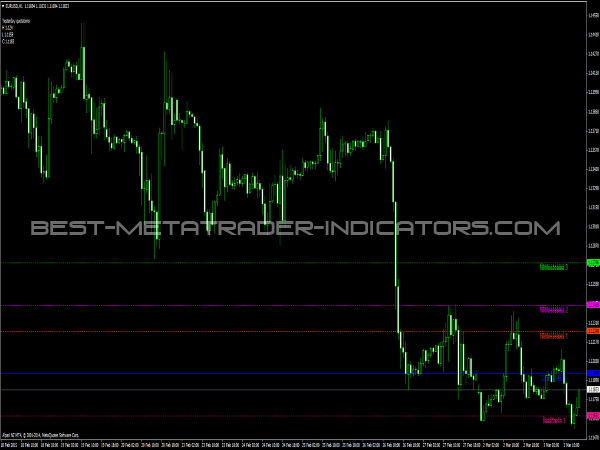

Real author:NitinThis indicator provides Buy/Sell arrows based on exit from the Overbought and Oversold zones in Stochastic Oscillator. A Buy arrow is printed when Stochastic oscillator exits from the Oversold Zone. A Sell arrow is printed when Stochastic oscillator exits from the Overbought Zone.

Fibonacci With Stochastic Indicator Examples

Very good indicator to collect some quick pips in scalping. Signals can appear in non-alternate manner i.e. A buy signal can be printed after a previous buy and similarly a sell signal can be printed after a previous sell. Popup, Email and Push notifications alerts are included.Image.